Property Buyer FAQs

We have answered some of our most frequently asked questions about how to buy property at auction. If you have any other questions, please don’t hesitate to get in touch.

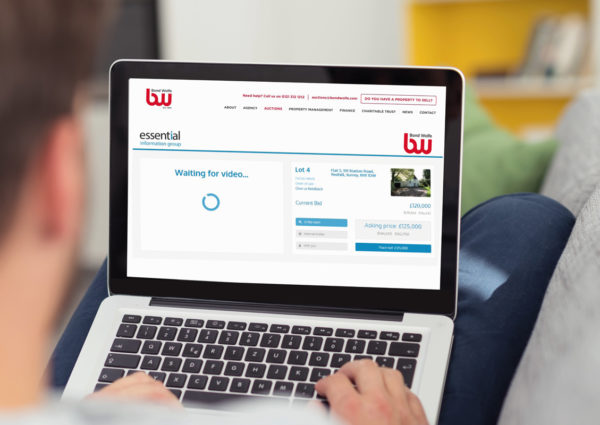

Our online property auctions are live-streamed via our website, bidding by telephone, proxy and online. Potential purchasers can register to bid on our website, securely register their debit card details and complete an anti-money laundering check before being authorised to bid, giving you the security of sale. All properties are sold subject to the usual auction conditions with an immediate exchange of contracts on the auction day and fixed completion date.

If you have pre-registered to bid online, you will receive an email from passport@eigroup. You will need an Auction Passport Account (you must register with the same email address you provided us for the system to identify you; otherwise, you won’t be able to bid). Please follow the link in the email to accept the terms and conditions and follow the instructions to ensure you are ready to bid.

On the day of the online property auction, you can ‘Log in to bid’ from our homepage, follow the link in the email or click here to watch the auction live and join in the bidding for any lot you are interested in (do not bid on any other lots, share your log in details with anyone else or leave your device unattended as all bids are legally binding). If you are having problems logging in it is usually because your Auction Passport Account is in a different email address. Try logging in from a different browser or logging out, closing all browsers/windows, following the link again, and entering the correct details.

If you have any further problems, you can either phone EI Group directly or you can contact our emergency help team at remotebids@bondwolfe.com. This is for emergencies only on the day of the auction, and they will be dealt with in the order in which they arrive. Alternatively, you can call our auction team on 0121 312 1212. General enquiries will not be dealt with until the day after the auction.

An online property auction can start and end on any day. The auction dates and times will be clearly detailed on our website. Interested parties must open an account and register to bid. Once you have been authorised, you can place your bids up to your maximum amount. You can see the other bids and adjust your bid up to the end of the auction if you wish to do so.

To buy property at auction online, you will need to click the login/create an account button on the online auction property you are interested in. If you are successful, you will need to submit your information and debit card details for payment of the deposit and administration fee (no payment will be taken unless you are the successful bidder). We will automatically undertake an AML (Anti-Money Laundering) check in order to approve your bid. (The AML check will leave a soft footprint on your credit report, but it should not affect your credit rating).

Yes, the majority of properties are available to view. We offer 360° video tours for the majority of vacant properties to give you an idea of the property before attending in person. We include as many properties as possible on our viewing schedule with the times and dates listed on our website, Rightmove, Zoopla and OnTheMarket. You don’t need to make an appointment to attend these viewings – you can turn up at the advertised time and day. Our staff are at each property for a maximum of 15 minutes before moving on to the next appointment, so please arrive on time.

If the property states by appointment, please get in touch with us at (0121) 312 1212 to confirm the date and time to attend. However, please note that not all properties are available to view, particularly investment properties or properties in serious/dangerous states of disrepair, video tours will also not be available for these lots which you purchase at your own risk.

We do not undertake any structural surveys, and if you have any concerns regarding the structure, we recommend that you instruct your own structural survey before bidding on the property. Your surveyor can contact us for access arrangements.

It is essential that you read all the legal documentation for each property you are interested in to fully understand the terms of your purchase and any costs that may be payable in addition to the purchase price. We also strongly recommend that you ask a solicitor to read them on your behalf. We upload all legal packs to our website as soon as they arrive from the seller’s Solicitors. They are all available to view free of charge (select the property from the properties page, and click ‘legal pack’ under the ‘lot information’). You should also read the Important Information and Common Auction Conditions applicable to all auction lots.

Some vendors will consider pre-auction offers. Offers can be made either in writing by emailing offers@bondwolfe.com or by clicking the ‘Make an Offer’ button on the individual lot page. Please note that the ‘Make an Offer’ button will only be displayed if the vendor is open to pre-auction offers. Before submitting any offer, you must view the property and read the legal pack thoroughly. All offers must exceed the guide price to be considered. If your offer is accepted, it will be subject to the usual auction terms and conditions, this includes paying a 10% deposit, an administration fee, and signing the contract prior to the auction date.

It depends on the individual property, and factors such as the condition, structural defects and mining report can all have an impact. We advise that you get your finances agreed upon and seek any legal advice before bidding at the online property auction. You can use your own finance/mortgage provider, or if you don’t have someone in mind or you need to arrange your finances in a hurry, we are happy to recommend Together Money. Whether you have a mortgage or not, it is always recommended that you have a survey in advance of the auction so that you are aware of any defects that may exist and ask your solicitor to check the legal pack/searches.

There may be amendments to the catalogue particulars, and we recommend that you keep yourselves updated regularly. Please refer to the Addendum on our website, which is updated as and when we are aware of any changes. It also includes details of any properties that have been sold prior or withdrawn and won’t be offered. The latest version is always available on the properties page of our website, or please refer to the individual property details for any updates (please note that any updates for the property auctions won’t feature on the addendum and will be made direct to the property details). We strongly advise that you check in advance of travelling to the auction and before bidding on any property.

The guide price indicates the vendor’s reserve price, the minimum price the property can sell for on the day/at the end of the online auction. It doesn’t necessarily mean the property will be sold for this price, as it depends on the level of interest, which can increase the final selling price.

The reserve price is confidential between the seller and the Auctioneer and is the minimum price that the seller is willing to accept.

Not always. The guide price is an indication of where the reserve price might be set. If the guide price is a bracket figure, then the reserve price cannot be higher than the top end of the guide price. If the guide price is a fixed figure, then the reserve cannot be more than 10% above the guide price. In some cases, the reserve price can be lower than the guide price.

Yes, they will need to register via our online registration system, provide details for you and themselves and a signed letter of authority granting them permission to bid. You must inform them that if you default on the purchase, they will be liable to complete the purchase themselves. For more information, please click here.

Yes, but you must include the details for each person who wishes to purchase the property at the time you register to bid (and each party will need to complete their AML check). If you don’t provide all the necessary documentation in advance of the auction, as the bidder, you take full responsibility, the property will go in your sole name, and you will be legally obliged to complete the purchase. For more information, please click here.

You can bid on behalf of a company if you are one of the shareholders and have 25% or more share capital. If you own less than 25% share capital or you’re acting as an agent/employee on behalf of the company, you must provide a letter of authorisation, signed by each shareholder, authorising you to bid. You must also provide details for yourself and for each shareholder with more than 25% share capital and each party will need to complete an AML check. For more information, please click here.

Yes, but payment of your funds should come from a UK bank account (you will need to provide a recent bank statement as proof) and appoint a UK Solicitor who will need to email us at remotebids@bondwolfe.com to confirm that they have been appointed to act on your behalf. You will need to register to bid, submit your debit card details with SagePay and complete an anti-money laundering (AML) check in accordance with our usual registration process. You may need to provide some additional documentation and we will advise you what is required at the time of your application.

You can enter your maximum bid in advance of the end of the auction. The bidding will still increase in increments (usually £1,000) up to your maximum amount.

A 10% deposit of the purchase price or £5,000, whichever is the greater, must be paid in cleared funds. You must also pay the administration fee of £2,340 inc. Vat (£1,950 plus Vat).

If you purchase a property for less than the minimum deposit of £5,000, then you pay the full purchase price plus the administration fee of £2,340 inc. Vat (£1,960 plus Vat).

As part of our registration process, you will need to submit your debit card details which will be authenticated and held securely with SagePay. NO payment will be taken upfront and we will only process your payment if you are a successful bidder.

Due to new legislation, it is now a requirement that online payments are checked via 3D security. This is setup with your bank and will usually involve confirming your payment authorisation via text message or within your online banking app.

In the event that you make a purchase, we will automatically take payment from your registered card. You must therefore ensure you have sufficient funds in your bank account for the 10% deposit, subject to a minimum of £5,000 plus the administration fee of £2,340 inc Vat (£1,950 plus Vat). Please note there is a maximum amount we can automatically take from your card, and you must be available by telephone on the auction day to make a top-up payment if required.

If your funds are being provided by a 3rd party, such as a relative either by way of a loan or gift (i.e. not including a bank or financial institution), for AML purposes, you must also provide their details as part of the registration process.

If you are unable to register your debit card details for any reason (such as you are buying on behalf of a company and don’t have a debit card), don’t hesitate to get in touch with us to discuss your circumstances and what alternative option we are able to offer.

If you purchase a property in our online auction, a payment of £7,340 will automatically be taken from the card you registered at the time of creating your account. We will contact you after the auction to take a top-up payment for any shortfall.

A buyer’s administration fee in the sum of £2,340 inc. Vat (£1,950 plus Vat) is payable on all lots immediately on the fall of the gavel/at the end of an online auction. However, the administration fee can vary for Local Authority lots. Please refer to the legal pack or speak to a member of staff for clarification. Any further costs in addition to the purchase price will be detailed in the contract/special conditions of sale within the legal pack.

When buying a property at auction, it can be quite common to pay costs in addition to the purchase price, and these are added to the contact/special conditions of sale by the vendor’s Solicitor. They can cover anything from search fees, legal fees, our fees, outstanding service charge or rent arrears, VAT and any costs associated with the property. Please click here for further information. Therefore, we recommend that you instruct your solicitor to inspect the legal pack before you place a bid so that you are aware of all costs relating to your purchase.

It is a legal requirement that we undertake an AML check for all bidders, buyers and anyone providing funds for an auction purchase. After submitting your debit card details (or in advance of doing a bank transfer), you and each party in your application will receive a link by text message and email from Credas to complete an AML check. This will include taking a photo of your identification such as your passport or driving licence and completing a liveness check by taking a selfie. If you create an account when registering to bid, you will only need to complete an AML check when you first register and every 12 months thereafter.

Upon exchanging contracts, you are responsible for ensuring the property. Please speak to your insurance company to make the arrangements, who will be able to advise you on the appropriate cover you require.

Completion is usually 28 days from the exchange of contracts but can vary depending on the seller’s circumstances. Please double-check the contract/special conditions of sale for each property you are interested in purchasing.

If a lot does not sell, then we may continue to market the property for 2 weeks post Auction (depending on the vendor’s circumstances), and you may make an offer. However, all offers will be under the usual Auction conditions.

If you default on the sale, you will lose your deposit and administration fee and may be sued by the seller for the balance of the monies owed and for any loss they may have incurred. Please speak to your solicitor or our auction team for further advice.

Please instruct your Solicitor as soon as possible after the auction so they can ensure everything is ready for completion. You will also need to put your Solicitor in funds, and they will arrange to transfer the money to the vendor’s Solicitor on the day of completion.

We will arrange to release the keys once we’ve had confirmation from the vendor’s Solicitor that the property sale has been completed. All keys must be collected from our Birmingham office. Please telephone us in advance of travelling to our office to ensure we have had authorisation to release them. If keys are unavailable, the purchaser will need to make their own arrangements for access. You must provide photographic identification to prove you are the purchaser before the keys can be released. If you wish for someone else to collect the keys on your behalf, you must inform us by email auctions@bondwolfe.com in advance, and they will need to provide identification for you and themselves.

Yes, please click here to register for our email updates to be the first to hear about our auction dates, properties and results. If you need any more information about how to buy a property at auction, contact our team.